China’s June manufacturing PMI dipped to 49.6, slipping below the neutral 50-point mark and snapping a three-month streak of marginal growth. On its face, this looks like another soft patch in China’s post-COVID industrial cycle. But if you zoom out, it’s more revealing than that. This isn’t just a quarterly wobble—it’s a systems signal.

What the S&P Global report highlights is not just a drop in export orders or slower production expansion. It’s a structural fragility in China’s export-led growth playbook—especially as it intersects with platform logic, supply chain dependency, and increasingly fragile buyer demand from the West. The “growth by external pull” loop is fraying. And the platforms that once supercharged China’s export agility—B2B marketplaces, live commerce, cross-border fintech rails—are now caught in the same demand downdraft they once defied.

This matters, not just for economists tracking PMI charts, but for platform operators and GTM teams watching their East-West leverage erode in real time.

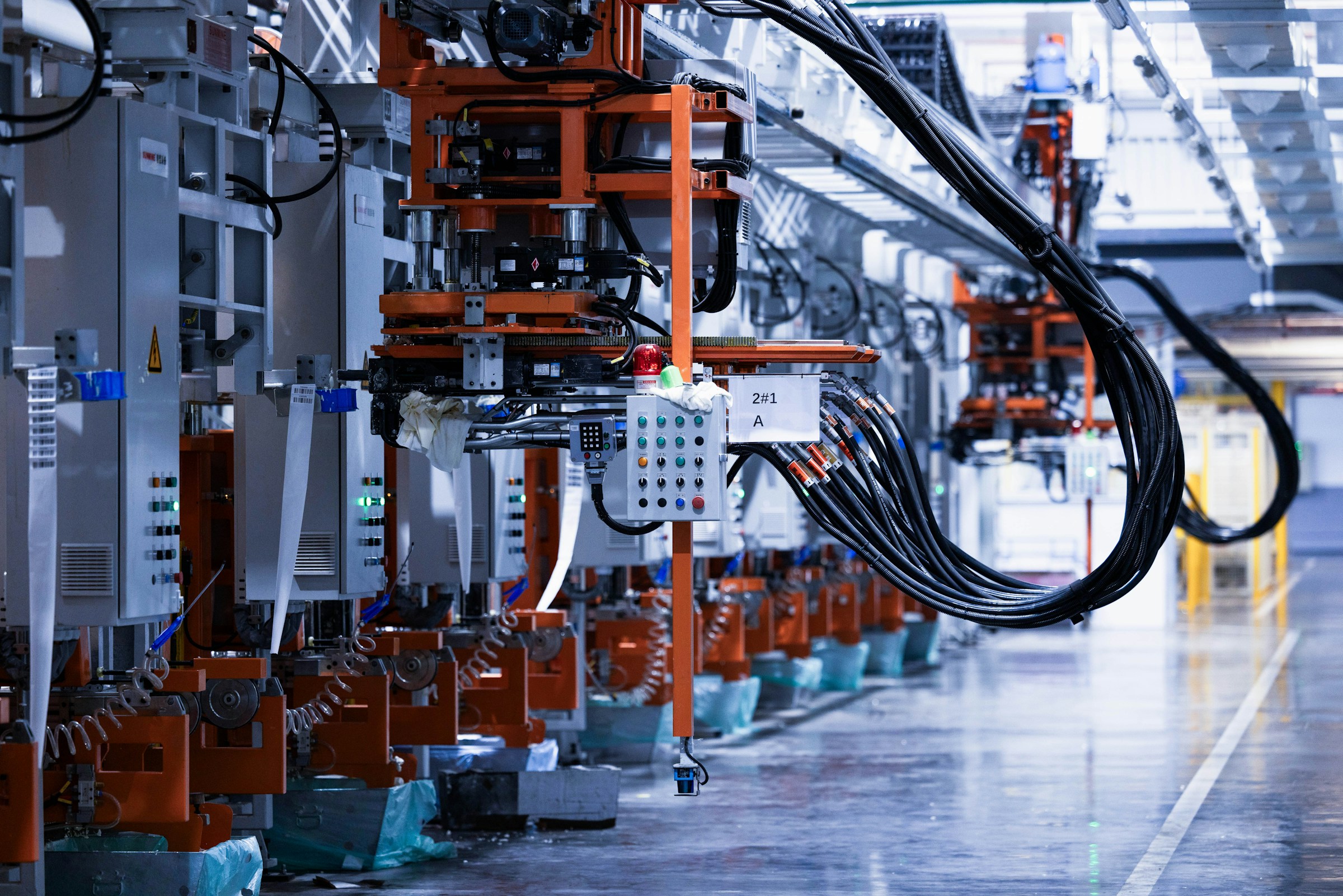

For years, China’s export resilience wasn’t just about volume—it was about integration. Digital infrastructure like Alibaba’s B2B arm, TikTok’s creator-commerce loop, and logistics supernodes like Cainiao created an unusually responsive manufacturing flywheel. When demand spiked, the system could sprint. When it stalled, it could reroute and reprice with shocking speed.

But that agility only works when there’s clear demand to serve. The June PMI’s sharp drop in new export orders signals something more broken: the pull signal itself is weakening.

This is where platform dynamics start to blur with macro. China's manufacturing system is highly digitalized, but it still relies on external signals to justify throughput. And when those signals—US retail restocks, EU festival season orders, SEA marketplace replenishment—falter, the entire flywheel sputters.

The easy read on weak PMI prints is to blame it on overcapacity or raw material lag. But that misses what’s changed post-2022. Supply isn’t the bottleneck anymore. Demand is.

What we’re watching is demand-side attrition—Western consumers slowing discretionary spending, B2B buyers deferring orders, and DTC brands throttling restocks in favor of leaner inventories. These are downstream effects of higher interest rates, inventory fatigue, and shifting consumer preferences away from physical goods toward experiences or services.

But this demand reset is uniquely dangerous for China’s platform-based manufacturing exporters. Their value proposition was speed, customization, and cost efficiency at scale. Without volume, those edges dull fast. High fixed costs in AI, logistics, and platform support don’t scale down gracefully.

This is the uncomfortable truth for founders and growth leads operating cross-border: your platform speed doesn’t exempt you from demand slumps. If your supply-side partners are bleeding orders, your CAC goes up, your commission pools shrink, and your retention strategies start looking hollow.

For example, TikTok Shop’s merchants—many of whom source from South China—are facing a double bind: weaker export demand and tighter platform policy shifts around subsidization and cross-border fulfillment. The margins that made the model fly in 2023 are now undercut by inventory drag and tighter consumer wallets. This isn’t a failure of platform design—it’s the exposure of its limits. You can’t spin up infinite growth loops in a demand-constrained world.

The China PMI print is a caution light—not just for macro forecasters, but for product teams building regionally dependent growth models.

If your GTM motion depends heavily on China-based suppliers, manufacturers, or drop-ship infrastructure, you’re exposed to more than just currency risk. You’re tethered to a velocity loop that now has demand friction baked in. Every export slowdown upstream becomes a conversion and retention issue downstream.

Watch for:

- Longer fulfillment windows even on digitized platforms

- Inventory aging in “fast fashion” or seasonal verticals

- Declining supplier responsiveness due to production cuts

- Payment term tensions between merchants and logistics brokers

These are the operational tremors that follow soft PMI prints. And they hit PLG models, creator economy plays, and even SaaS companies with physical enablement layers.

This PMI contraction isn’t about factories. It’s about a platform economy reaching the edge of its old assumptions. For too long, export-led growth logic assumed Western consumption would absorb whatever China could produce—faster, cheaper, smarter. That assumption fueled not just GDP, but the entire productization of China’s digital manufacturing stack.

But when demand stalls—and when platforms no longer have subsidy levers or aggressive credit terms to juice it—operators have to rewire their growth math. So if you're a founder betting on China’s production agility, remember: agility isn't immunity. And export-led platforms are only as fast as their slowest signal. This isn’t just a PMI blip. It’s the noise of a growth engine grinding against structural constraint.